The precious metals market, without exaggeration, became the loser of 2021. At a time when stocks around the world broke record after record and brought investors impressive returns from 40% to 60% per annum, gold brought only disappointment to holders, losing about 9% YoY. This makes many investors reconsider their view of the role of gold in their portfolios. However, when deciding to exclude gold or gold mining companies from the portfolio, it should be remembered that at a distance of 20 years, gold brought investors an average return of 10% per year, but at the same time, you should also not forget that at a distance of 10 years, gold gave an increase below inflation, only 0.04% per annum.

Of course, we are talking about buying gold for US dollars and other currencies, the situation is not so sad. But the fact remains that in the conditions of the modern financial model, having one of the largest liquidity among other assets and remaining one of the most manipulated goods, gold for the most part does not justify the hopes placed on it for rapid enrichment. Gold is an investment for the patient.

The situation with silver is even sadder than with gold. Due to the industrial revolution of renewable energy sources, silver was given very large advances, but it is not in a hurry to work them out. Moreover, silver is closely related to gold, so it will rise and fall with it, and therefore it is unpromising to consider the silver market in isolation from the gold market.

At the same time, being one of the most liquid assets in the world, gold is always present in the portfolio of a trader seeking to make money on fluctuations in its price. In the context of making decisions in the medium term - from one month to six months, taking into account the inter-market technical analysis and seasonal factors today, we will consider gold.

Unfortunately, the seasonal factor does not favor the price right now. As the analysis of seasonal supply and demand for the period of 5, 10, and 20 years shows, prices peak in August and September, after which a period of seasonal decline in quotes begins until December. Then, with the onset of December, the price of gold begins to rise against the background of the celebration of the Chinese New Year. As we know, prices this year peaked in May, when gold reached the level of $1,920 per troy ounce, but then it could not develop its success, reaching prices at the level of $1,830 in August and September, which, in my opinion, shows the weakness of gold on the eve of the beginning of autumn.

One of the main sources of demand for gold is the demand from exchange-traded funds ETFs, where the largest role is played by large funds from the United States and Europe, including the United Kingdom. According to the data of the World Gold Council, in August, large funds from the United States continued to sell gold (Fig. 1), which led to a decrease in quotes. At the same time, smaller funds from Europe and Asia bought gold, but against the background of massive sales in the United States, this could not support the quotes.

Fig. 1: Dynamics of purchases of exchange traded funds

It is very difficult to predict the behavior of gold holders in exchange-traded assets. However, you can look at the position of traders on the CME-COMEX futures exchanges by analyzing the COT - Commitments of Traders report. Unfortunately for gold and silver, there is also nothing positive here yet. The demand for gold, the so-called Open Interest, has been at minimum values throughout the year and now amounts to only 640 thousand contracts. A little positive is added by the growth of long positions, the groups of the main buyers of Money Manager began to grow slightly from their lows. Over the past four weeks, futures purchases have increased from 123,000 to 154,000 contracts, which is almost 400 tons (Fig. 2).

Figure 2: Gold Price and Long Positions of Money Manager on CME-COMEX

This may be a forerunner of price growth, but so far there are very few hopes for this, especially against the background of other factors, such as US bond yields. Talk that the Fed will soon reduce the pace of asset purchases adds opportunities for growth in the profitability of risk-free instruments.

The technical analysis of the chart of 10-year Treasury bonds also signals an increase in the yield, or at least its stabilization in a narrow range between 1.3% and 1.60% (Fig. 3). As can be seen from the chart, the growth of the TNX yield from August 2020 to March 2021 had the most negative impact on the gold price. In turn, the decline in bond yields from 1.75% to 1.35% led to the slight recovery of the price of gold.

Figure 3: US Treasury Bond yields

In fairness, it should be noted that there is no linear relationship between gold and bond yields, but over the past ten years, the increase in bond yields in most cases affected the price of gold negatively. At the same time, the growth of inflation also does not add positive to investors yet, but it should.

In the current situation, when analyzing the price, the interaction of gold with the dollar should also be considered, since, in the medium term, the influence of the dollar on gold quotes can be quite significant. Based on this assumption, we can conclude that the growth of the EUR/USD exchange rate will be positive for gold, and vice versa - the decline of the euro will be negative. Currently, there is no certainty in the dynamics of the euro against the dollar, but a decline in the EUR/USD rate meets the interests of central banks seeking to curb inflation, so from a fundamental point of view, such a decline is quite likely.

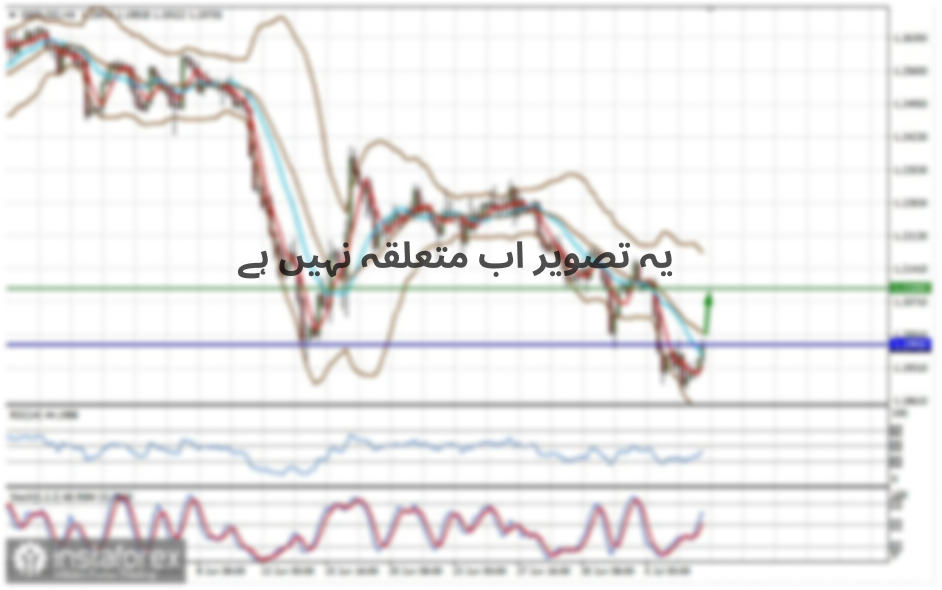

Figure 4: The technical picture of gold price

Summing up and drawing conclusions, it can be assumed that the price of gold in the future from one month to six months is more likely to decline than to grow, and in the best case, it will remain in a wide range, the upper limit of which will be the resistance of $1,840 per ounce. The lower limit of the range will be the support level of $1,720 per troy ounce, which allows traders to sell from the upper limit of the range to the targets located at $1,760 and $1,720.

Mark Mobius of Mobius Capital Partners recently stated that investors should have a 10% gold content in their portfolios, based on his point of view, world currencies will depreciate in 2022 as a byproduct of COVID-related incentive packages. He believes that the devaluation will also be caused by consumer inflation.

John Paulson of Paulson and Company became famous for his work during the global financial crisis when he closed short positions on subprime mortgage bonds with huge profits. When asked if gold is a good investment today, he replied: "Yes, we really [think that gold is a good investment]. The amount of gold invested is very limited. This is about several trillion dollars, and the total amount of financial assets is approaching $200 trillion. As inflation increases, people are trying to get rid of fixed income. They are trying to get out of the money. And the logical place for this is gold." Paulson is convinced that inflation will rise much higher than people expect, and in this scenario, gold will have very high results.